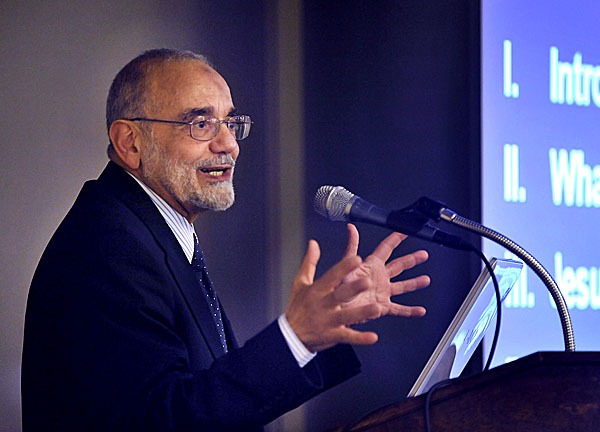

Fiqh of Zakah Q&A with Dr. Jamal Badawi (Written Answers)

MAC Ramadan Webinars: Fiqh of Zakah Q&A with Dr. Jamal Badawi

Date: April 30, 2020

Written Answers to Submitted Questions by Dr. Jamal Badawi

Q1: We hear different opinions on Zakah payment on stock market investments. Some say Zakah is payable on income and the values of the stocks. Others say, it is similar to rental properties, in which case Zakah is payable only on the income and not the value of the house, if the niyyah [intention] is to earn an income and not to “flip”, then Zakah is only due on income and profits and not on the value of the stocks. What is Imam Badawi’s opinion?

Answer: If renting properties is the primary source of income [e.g., investors in real estate as a profession or business], Zakah is payable only on the net income and not the value of the house. If investment in real estate is to earn extra income [e.g., a medical doctor who invests excess funds], then Zakah is due on the value of the rental house, also the net profit of rental income.

As to stock market investment: If this is the primary source of income, then Zakah is due on the net profit for any given Hijri year. If such investments are made to earn extra money, then Zakah is due on both the stock value and net profit or dividends.

Q2: Who is eligible to pay zakat or who is it obligatory for?

Answer: Zakah is obligatory on any adult and sane Muslim whose Zakatable assets reaches the “Nisab”; current value of about 3 ounces of gold. Zakah is due if such assets has been owned by the person for one Hijri year. If the person is a minor, his guardian or estate manager should pay it from the minor’s property on behalf of the minor until he reaches the age of maturity and is able to manage his own property.

Q3: What is the best method to calculate Zakat? Do we use the amount we have in our bank now or the previous Ramadan to account for money we have had for one Hijri year? How do we consider our monthly expenses?

Answer: Zakah is due on the Zakatable wealth that the person has owned the “Nisab” for one complete Hijri year. Your actual monthly or annual living expenses are not Zakatable.

Q4: When should we give Zakah?

Answer: You can give it when it is due as explained above. Paying it during Ramadan is rewarded manifold. Some jurists are of the opinion that payment of Zakah before it is due [completion of the Hijri year] is permissible, especially at present when individual and institutional needs, such as Masjids and Islamic centers, are pressing and urgent.

Q5: Do you pay Zakat on the entire amount of Corporation Cash or do you pay on the after-tax money?

Answer: You pay after it has been received, meaning after tax.

Q6: I have some savings, not much, but now that I don’t have payroll, I’m relying on it. Do I have to pay zakat on it? I usually pay my zakat in Ramadan

Answer: If your savings are less than the “Nisab”, you are not required to pay Zakah on it. If it reaches the Nisab for one Hijri year. Same applies to subsequent years.

Q7: How do we calculate Zakah on gold given as a gift (i.e. from grandmother to grandchild)?

Answer: If the grandchild is a female, she is entitled to keep it for her personal use. If the grandchild is a male, the entire gift is Zakatable. It is haram for Muslim males to wear gold. Most jurists are of the opinion that women’s jewelry are not Zakatable. See more details and references in the answer to Q20

Q8: Can we give Zakat to our own sibling if he/she is eligible to receive Zakah.

Answer: Yes, and it is doubly rewarded. You receive the reward of paying Zakah and the reward of connecting with and kindness to needy relatives.

Q9: How much of our Zakah can we give to siblings who may be Zakah – eligible?

Answer: It is all up to you, based on your resources, the extent of need and the number of Zakah-eligible persons.

Q10: How do you pay Zakat on RRSP monies that are invested in the stock market?

Answer: Please refer to the answer to Q 24 below.

Q11: Do we have to tell the person we are giving Zakah to that you are giving this as your Zakah to them?

Answer: Not necessarily, what counts is your intention. Telling them may hurt their feelings.

Q12: A.A. and Thank you for your efforts.

مصارف الزكاة واضحة في القران الكريم

ما حكم صرف الزكاة لمساعدة المدارس والمراكز الإسلامية في كندا؟ علما انه في بلاد المسلمين لا يصح مساعدة المراكز الإسلامية من أموال الزكاة و لكن ما رأي العلماء عند التحدث عن وضع المسلمين و المراكز الإسلامية في بلاد الغرب

Summary of the Arabic question: Is it permissible to pay Zakah to help Islamic schools and centers in the West

Answer – Arabic: أفتى بعض العلماء المعاصرين بجواز ذلك حرصا على هوية ذراريهم تحت مصرف “وفي سبيل الله

Answer-English: Some contemporary jurists accepted that, if the intention is to serve the cause of Allah and protect their and the identity of their children. In this case such key Islamic institutions are Zakah-eligible, based on an interpretation of the category of “in the Way [cause] of Allah”.

Q13: I heard that except for parents, you can pay Zakah to anyone who is not dependent on you in terms of family. For example, a mother can pay Zakat to a son as he is not dependent on his mother. Can you clarify that?

Answer: That is right. You can’t give Zakah to your dependents [e.g. wife and children].

Q14: I have a dental office; how do I pay Zakat on my business?

Answer: A general rule is that no Zakah is due on income-producing assets. It is due, however, on any excess income and Zakatable assets from all sources, beyond fulfilling your needs [living expenses] if they reach the Nisab. And you had it for one Hijri year.

Q15: What’s the difference between Zakat al Fitr and zakah (zakat al mal) in general?

Answer: Zakat al-Fitr is paid in Ramadan [in Canada, currently, it is about Can$10 per person] on behalf of yourself and each of your dependents. It is intended to help needy Muslims to celebrate Eid. Earlier payment [any time in Ramadan] allows enough time to distribute it ahead of Eid. Please refer to answers to Q2 , Q3 & Q4 on Zakat-al-Mal.

Q16: How do you deal with loans, especially mortgages when calculating Zakat?

Answer: First, try earnestly to find an alternative to interest-based mortgage. If the mortgage relates to your principal residence, you do not pay Zakah on mortgage, as your principal residence is non-Zakatable.

Q17: I have a question about how to pay zakat on the following types of investments: investment in a business, RRSP’s, stock market investments, real estate investment. Do we pay Zakat on the original amount we invested or on what the stock is worth today, or only on the profits during the year?

Answer: Please refer to answers to Q1 and Q24 for the first part of the question. As to investment in a business, it applies to your net profits, also the net value of unsold goods.

Q18: How is Zakah calculated? Given that someone still has a loan (but the income exceeds the loan)

Answer: Zakah is paid on Zakatable assets minus Liabilities [such as loans].

Q19: Can We give Zakat (the two Zakats) to non- Muslim people?

Answer: On Zakat al-Fitr, please refer to answer to Q 15 above. As to Zakat al-Mal, some jurists allow their inclusion if they are needy.

Q20: Do you pay zakat on jewelry you wear?

Answer: There is a range of opinions about this issue. Some jurists [e.g. Hanafis] are of the view that Zakah is due on the entire amount of jewelry possessed by a woman if it reaches the Nisab. The other three Madh-habs are of the view that women are exempt from Zakah on jewelry , regardless of value. See S. Sabiq, Fiqh al-Sunnah under “Zakat al-Huliyy”. Dr. Yusuf al-Qaradawi in his extensive 2-volume work called “Fiqh al-Zakah” [the 8th printing] discussed and evaluated in great details the arguments of both sides and concluded that the exemption argument is stronger [Vol 1, P.292

Q21: If you have gold that has stones. i.e. diamond ring, ruby ring etc. How do we decide the worth because it doesn’t work with weight?

Answer: Jurists differ as to whether precious stones acquired for personal use are Zakatable or not. The majority believe that it is not Zakatable. However, If they are used for commercial purposes, they are Zakatable.

Q22: If you didn’t pay Zakat before, what can you do now. i.e., You weren’t religious before. Can you do alternative things such as giving Sadaqah [charity] or feed the orphans and the poor, with the intention of fulfilling the missed Zakah payments?

Answer: First of all, congratulations. May Allah (SWT) bless you and increase your faith and love of Allah. As Zakah is mandatory, the priority for you is to intend eligible charitable donation as payment of missed Zakah. Orphans and the poor are legitimate recipients of Zakah.

Q23: If I saved money to buy a house, do I have to pay zakat on that money?

French: Si j’ai économisé de l’argent pour acheter une maison, dois-je payer la zakat sur cet argent?

Answer: If your savings reached the Nisab, about 3 ounces gold and you had it for one Hijri year, it is Zakatable at the rate of 2.5%. The same applies to subsequent years. Once you use the saving to buy the house, it will be no longer be Zakatable since your principal residence is non-Zakatable.

Q24: Is Zakat required for RRSP? If yes how is it calculated knowing that contributions are monthly (employee and the employer contributes each month) on this account?

Answer: In an answer to a similar plan [401K], common in the USA, Dr. Muzammil Siddiqi, current Chairman of the Fiqh Council of North America referred to the conclusions of a scholarly committee led by Maulana Mujahidul-Islam Qasmi, namely:

- The employee’s contribution to the fund is Zakatable if done by choice.

- If funds are collected compulsorily by the employer, then Zakah will be due on these funds when they can be withdrawn.

- Zakah on the Employer’s matching contributions is due until they can be withdrawn.

- When funds can be withdrawn and they reach the “Nisab” and after the passage of one complete [Hijri] year, then Zakah becomes due at the rate of 2.5%

[Dr. Siddiqi’s report appeared in Islam online on 2003-09-11. Also, Amja’s fatwa # 87310, states “… since Zakah is only compulsory on assets you have complete ownership and possession on, you estimate the amount of money you will walk away with if you withdraw it from the fund now”. ]

Q25: What is considered halal stocks and what is not halal for investment purposes?

Answer: Halal stocks are the ones which only include companies whose primary business is Halal in Islam. Haram investments are ones which include business(es) whose primary product is Haram, such as stocks in banks, insurance companies, gambling casinos, pork trade and processing or any business whose products and/or services are contrary to Islamic rules and ethics. Consult with your local Imam for details.

Q26: Who must pay Zakah?

Answer: Please refer to the answer to Q2 above

Q27: Are political donations Zakat eligible for the sake of softening hearts (i.e. turning them to Allah, SWT)?

Answer: This category is decided on by the genuine and committed leader of the Ummah based on the best legitimate interest of the Ummah [not his own]. You can donate as an individual or group from other than Zakah, which has specified categories of disbursement, most importantly to fulfill the needs of the poor.

Q28: How should equity investments be included in zakat al-mal? Do RRSPs get a different treatment?

Answer: Zakat al-Mal is due on all Zakatable assets, whose total reaches the “Nisab” and you have it for one complete Hijri year. As to RRSP, please refer to the answer to Q24 above.

Q29: Should I deduct my credit card balance before calculating zakat amount?

Answer: Any amount you owe can be deducted from your Zakah. Please note that you must pay your credit card balances during the grace period before you incur any interest charges.

Q30: People who belong to Ahlul Bayt are not entitled to receive Zakat al-Mal from average Muslims. We don’t have Baitul Maal nor any Waqf nowadays so is this ruling still applicable?

Answer: If there is any person who belongs to Ahlul Bayt [Such as Banu Hashim, close relatives of Prophet Muhammad , peace be upon him, and who is needy, it would be the obligation of the community to help them with a “gift” as needed.

Q31: Can you give zakat al-Fitr to a person who is in debt ?

French: Est ce qu’on peut donner zakat Al fitr à une personne qui est endettée? عندها دين

Answer: Yes, If the person is poor and in need.

Q32: Is it possible to send Zakat al-mal outside of Canada (i.e. to our family or where we think that there is greater need than here in Canada)?

Answer: I am not aware of any prohibition to do so, provided that local needy Muslims are cared for first and your relatives are Zakah-eligible

Q33: Organizations such as Naseeha that provide advice over phone calls to at risk youth and others, are they considered to fall under the 8 categories as mentioned in Surah Taubah verse 60.

Answer: They may qualify if this activity may soften their hearts and help them return to the guidance of Allah [SWT].

Q34: Can Zakat be paid to build Masjids?

Answer: Generally, Zakah should not be used to build Masjids. If the community is financially unable to build even one simple structure then Zakah can be used, as an exception. Some jurists, however, and in view of the Muslim [numerical] minority situation, consider as Zakah-eligible such institutions, especially Islamic schools that aim at preserving the Islamic identity and Da’wah institutions, including Masaajid/Islamic centers. See Yusuf Al-Qaradawi’s Fataawa Mu’aasirah [First printing], Vol. 2, pp. 227-229 and 232-234

Q35: At what age do you have to give Zakah?

Answer: Please refer to answer to Q2 above

Q36: Is there Zakah on retirement saving, e.g. RRSP employee pension/retirement plans and RESP educational saving plans.

Answer: Please refer to answers to Q24.

Q37: Do you think if we apply zakat in our community and the entire community has one pool of Muslim zakat then Muslims can provide a great alternative to the secular financial system today and create a substitute insurance system?

Answer: The idea is excellent, but not from Zakah, which has specific disbursements. This is especially true since Western Muslims are generally more well off as compared with their brothers and sisters who are literally starved in other parts of the world.

Q38: I sold my business and the money I received selling is what I am using for my current living.

Answer: Zakat al-Mal is due on all Zakatable assets, whose total reaches the “Nisab” and you have it for one complete Hijri year. Nisab is the worth of about 3 ounces of gold at the current price.

Q39: Some scholars say RESP funds are “inaccessible”, so Zakah is not payable, until it is cashed. What is your opinion?

Answer: Please refer to answers to Q24

Q40: Do I need to pay zakat for the cash I have?

Answer: All Zakatable assets include cash.

Q41: What is the scholars opinion and reference about paying Zakat money to support Islamic schools and centers in Canada knowing that this is not part of the 8 official way to pay zakat.

Answer: Please see answer to Q34 above. This is based on interpretation of the category “fi sabeel Allah”.

Q42: I put a certain amount of my money on an investigation bank account for retirement. Should I include them every year to calculate my zakat?

Answer: Since you own that money and have control of it, then it is Zakatable every year on its relevant current value.

Q43: Nisab last year was about $4000 and this time due to the crisis it is about $6000. This is an unusual jump. How do we count the year if for 10 months we had $5000 and only in the last two months we had above $6000?

Answer: Nisab amount is based on the current value at the time to paying your Zakah.

Q44: I have a loan, can I deduct the amount of the loan from the cash I have?

Answer: Zakah is due on your Zakatable assets minus what you owe to others.

Q45: Is there a threshold for indebtedness/leverage that a company must operate within in order to be halal? for ex. if a company is in too much debt and is paying a lot of its cash flow in interest, is there a certain point in which you would say this company is haram to invest in?

Answer: I am unaware of a definitive threshold. I would be more comfortable shifting the investment to a less questionable investment.

Q46: Do I pay the post-tax amount on the value of RRSP?

Answer: Please refer to answer to Q 24 above, especially Amja’s fatwa # 87310, states “… since Zakah is only compulsory on assets you have complete ownership and possession on, you estimate the amount of money you will walk away with if you withdraw it from the fund now”. I interpret the expression: “…estimate the amount of money you will walk away with if you withdraw it from the fund now” as the market value of your fund minus any charges and penalties if you were to withdraw it at the time of calculating your Zakah.

Q47: What about value items that are collector items like baseball cards or art. Does it depend on the intent? If the art is for enjoyment.

Answer: I see no ground to classify this as Zakatable, unless they are kept for commercial purposes.

Q48: How about rental property that still have mortgage?

Answer: If renting properties is your main source of income, Zakah is based on net profit. If it is not, then Zakah is due on the net value of the property [ies]

Q49: For Zakat al-mal, is it supposed to be done in money only? Is it permitted to buy food or other needs and give it to the needy?

Answer: Zakah could be in cash or in-kind or any other combinations.

Q50: Do you pay zakat on your house?

Answer: No, if it is your principal residence, then it is non-Zakatable.

Q51: Is the amount of zakat the same in all provinces of Canada, because the standard of living is different from one province to another?

French : Est-ce que le montant de la zakat est le même dans toutes les provinces du Canada, car le niveau de vie diffère d’une province à l’autre?

Answer: Standard or cost of living is irrelevant in calculating Zakah. Zakah is based on Zakatable assets, whose Nisab is based on the price of about 3 ounces of gold, which is relatively more stable and usually consistent with international price.

Q52:Can you please share a link or website about the fatwa, details and conditions of the halal mortgage that was discussed with Sheikh Qaradawi?

Answer: For details, please see the site of Islamic Co-operative Housing or similar shari’ah – compliant organizations. One common model is based on the concept of shared equity and rental.

Q53: Can I pay my Zakah and Zakat al- Fitr for people in my home country not here in Canada? as I know needy people there and I can be of more value there.

Answer: You can if there is no needy Muslim in your locality.

Q54: Can I pay Zakat to family members? I have a brother who is not working and has 2 kids and doesn’t own anything. He is not extremely poor but doesn’t have any savings, income or property to sell.

Answer: Yes, if they are needy [even not extremely poor]. However, you can’t pay Zakah to your dependents [e.g. wife, children or other dependents].

Q55: Is mortgage Riba?

Answer: If you mean mortgage to finance your home purchase, then yes, it is an interest -bearing and is haram. Please explore other Shari’ah-compliant home financing. Some but not all scholars allow conventional mortgage if there is a necessity and no other Shari’ah-compliant home financing is available and with strict requirements. I do not recommend that since there are a lot of other Shari’ah-compliant means available. Any concession on that issue by a qualified Mufti and for compelling circumstances does not mean making riba Halal.

Q56: What if I don’t have cash to pay zakat for a land worth $400k?

Answer: it is still a Zakatable asset. Zakah on land is not due unless you had it for one Hijri year. Pray that Allah [SWT] will give abundance of Rizq [provision] without having to sell it whole or in part. If you build your principal residence on this land, it becomes non-Zakatable.

Q57: If a wife and husband have a joint account, are they entitled to pay Zakah together or separately, depending on each Nisab

Answer: Each of you need to pay Zakah according to his/her personal assets and Nisab.

Q58: Is it better to pay Zakah in Ramadan or عشر ذي الحجة

Answer: Both are blessed days. From Hadeeth, it looks like Ramadan is better. This is my personal practice.

Allahu A’lam. Ramadan Mubarak to all and sincere prayer to Allah [SWT] to protect you from the corona virus, cure those who are infected and help all humanity to repent to Allah and reflect on their journey on earth and beyond.

Tax given to the government every year in Canada on your income can be included as zakat.